How to File a Claim for Windshield Replacement Through Car Insurance

July 31, 2024

Many car owners suffer from windshield damage due to bad weather and road debris, resulting in cracked windshields. Identify your coverage, monitor the damage, and handle the claims accordingly.

When you know what your insurance covers and take the proper precautions, filing a windshield replacement insurance claim can be made easily. Submit a windshield replacement claim with your car insurance company.

Let’s see how to do that.

Understanding Your Insurance Coverage

Know your insurance policy before submitting a claim for windshield replacement through your car insurance claim. These replacements and repairs are covered by car insurance coverage.

Depending on the scope of the coverage, some plans may make you pay a certain percentage of the windshield replacement cost, and others give complete coverage for windshield repair with no deductible. To understand what is covered by your plan, check your policy documentation or get in touch with your insurance company.

Assessing the Damage

Analyzing the seriousness of the windshield damage is the first stage in the claim’s procedure. It could be possible to fix a minor chip or crack without replacing it entirely if you find any.

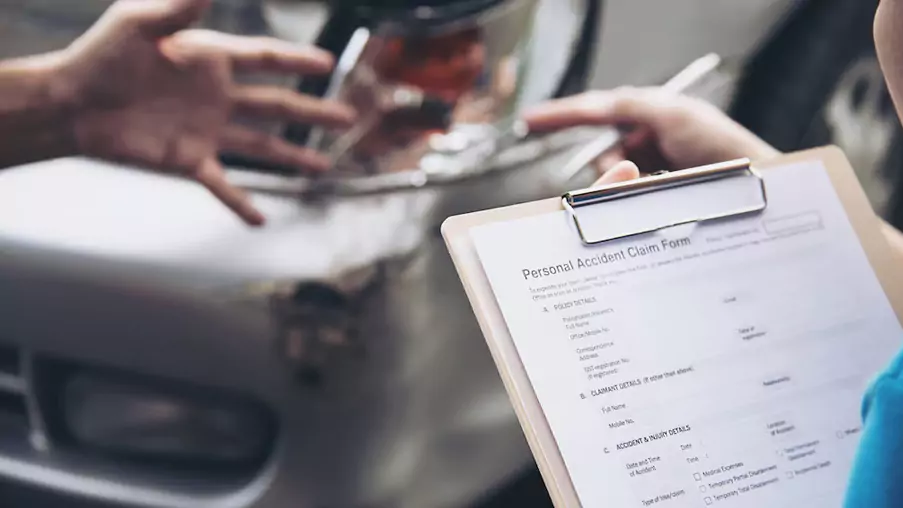

A complete windshield replacement is required when it has a massive break and blocks your visibility. Click and record the distortion-free images of the damaged area before submitting your claim to your insurance provider.

Also, mention other factors contributing to the damage like inclement weather conditions or road debris.

How to File a Claim – Step-by-step Process!

A windshield replacement claim must be filed in the following ways:

- Speak with your Insurance Company: Inform your Insurance provider about the damage. Most insurance companies offer an online claim website or a 24/7 claims helpline.

- Give the Required Information: Provide desired information such as the date and reason for the damage, your insurance number, and pictures of the cracked windshield.

- Observe the Instructions for Claims: The necessary steps required to file your claim are processed by your insurance company; they may involve filling out a claim form or supplying more supporting evidence.

Choosing a Repair Provider

Select a reliable repair provider to ensure outstanding service and smooth claims processing. Companies with a reputation for excellence in auto glass replacement and repair, like NuVision Auto Glass.

Additionally, they provide ADAS Calibration service, which may be required if your car has advanced driver-assistance technology. You can select an independent, accredited repair shop or check the list of approved providers offered by your insurance carrier.

To ensure you’re getting the best possible customer service, it’s also a good idea to go through reviews and ask for suggestions.

Navigating the Claims Process

After you submit a car insurance claim, your insurance company will review the details, and if the claim satisfies their requirements, they’ll authorize it.

They could handle the money directly through negotiation with the repair provider, or they might pay you back when the repair is completed. Maintain a record of all correspondence and documents related to your claim for future use.

It’s important to check out your insurance provider regularly to ensure your claim is moving smoothly and to know if any possible problems arise. To speed up the process, be fast in supplying any extra data or supporting documents that may be required.

Dealing with Deductibles and Costs

It’s important to know your deductible before submitting a claim. The amount you must pay out-of-pocket before your insurance pays the rest is deductible.

For example, if the windshield replacement cost is $300 and your $100 deductible, you are responsible for $100, with the remaining $200 covered by your insurance.

Check with your provider to see whether your policy offers a zero-deductible option for auto glass repair.

Tips for Smooth Claims Processing

- Move Swiftly: To prevent issues/delays, submit your claim once you know the damage.

- Maintain Documents: Keep a file of any correspondence with your insurance company and the repair center.

- Subsequent Action: Keep an eye on the progress of your claim to ensure it’s being handled quickly. This proactive strategy can help in quickly resolving any problems.

- Select High-Quality Repair Services: Select reliable and licensed repair companies like NuVision Auto Glass to ensure excellent work and reduce the possibility of more issues.

- Give More Details Quickly: To speed up the process, be fast in supplying any extra data or supporting documents that may be required. Efficient and transparent communication may improve the claims procedure.

Conclusion

Filing a windshield replacement insurance claim doesn’t have to be difficult. You can ensure a seamless and effective claims process by knowing your insurance coverage, accurately estimating the damage, and following the right procedures.

Reliable and competent services are offered by businesses like NuVision Auto Glass to assist you in securely getting back on the road. To save challenges and optimize the advantages of your coverage, remember to take immediate action, maintain detailed records, and select high-quality repair providers.

Act fast if your windshield is damaged! Book for your replacement or repair and ensure your safety while driving. Contact NuVision Auto Glass today.